18+ Fannie and freddie

And hoping to head off a government takeover Freddie Mac is looking to sell 55 billion. The markets renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago.

3 Things To Know About Fannie Mae Freddie Mac Ginnie Mae Fannie Mae Mortgage Banker Mortgage Companies

Fannie and Freddie are currently owned by the United States government and regulated by the Federal Housing Finance Agency.

. Fannie Mae and Freddie Macs Multifamily Administrative Costs 2002-2011 89 Table 20. Archived from the original on September 12 2008. Despite these efforts by August 2008 shares of both Fannie Mae and Freddie Mac had tumbled more than 90 from their one-year prior levels.

Archived from the original PDF on September 9 2008. Fannie Mae was created in 1938 as the Federal National Mortgage Association FNMA a financial organization that was owned by the government. Ad Simple Adaptable Innovative.

The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand likely resulting in continued price growth. Fannie Freddie regulator wants to help more low-income homebuyers. Fannie Mae and Freddie Mac.

Retrieved September 7 2008. Federal Housing Finance Agency. Fannie Mae and Freddie Mac are large companies that guarantee most of the mortgages made in the US.

Bush said about troubled the mortgage giants Fannie Mae and Freddie Mac was we have to make clear that conservatorship is transitory because otherwise it looks like nationalization. Questions and Answers on Conservatorship PDF. Together they are also known as the government sponsored enterprises GSEs.

On October 21 2010 FHFA estimates revealed that the bailout of Freddie Mac and Fannie Mae will likely cost taxpayers 224360 billion in total with over 150 billion already provided. A rescue plan is in the works for Freddie Mac and Fannie Mae but again today stock prices rose for both. Fannie Mae remained a government owned entity for the first three decades of its existence with a near monopoly over the secondary mortgage market.

According to his memoirs as secretary of the Treasury Henry Paulson left the Oval Office on Sept. Shares of Fannie Mae and Freddie Mac dove to their lowest levels in more than 18 years on mounting fears of a government bailout that would wipe out shareholders of the two. Lockhart James B III September 7 2008.

What is the impact from the falling stock market prices on mortgage rates. The record-breaking 18 percent increase in Fannie and Freddies 2022 baseline conforming loan limit to 647200 in most areas of the country means the new ceiling for one. The Federal Housing Finance Agency wants at least 35 percent of purchase loans to go to low- and very low-income borrowers.

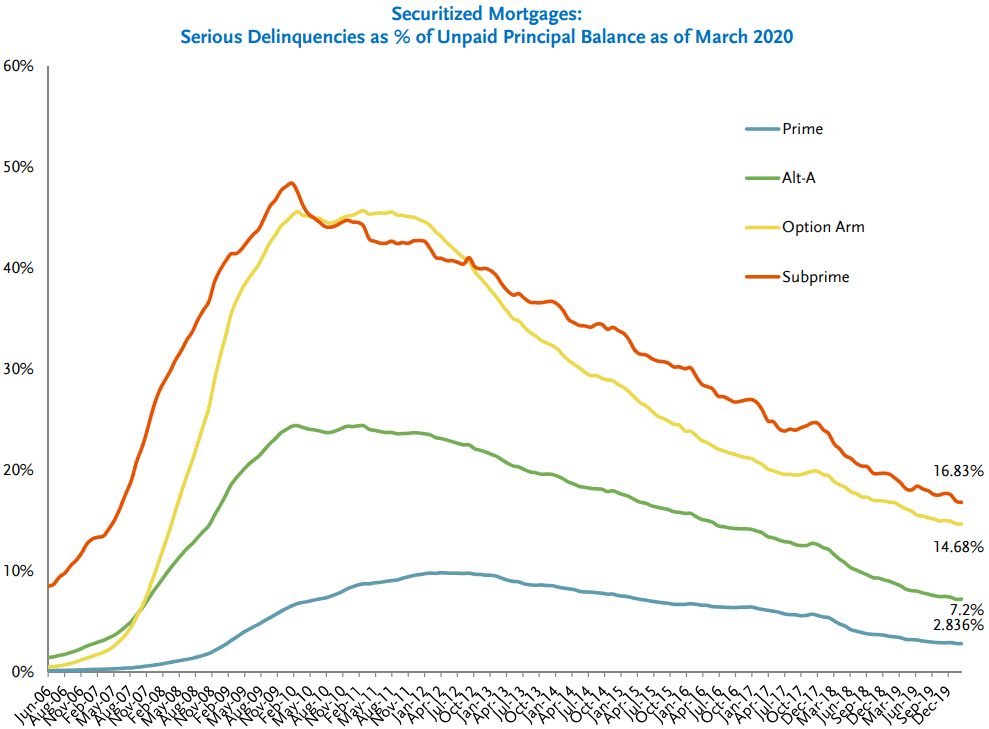

Historically they were private companies operating with government permission and under government regulation. Fannie Mae and Freddie Macs Serious Delinquency Rates for Multifamily Loans with LTV Ratios Greater Than 80 Percent 88 Table 19. Fannie Freddie fees on 2nd homes conforming jumbos go up April 1 Mortgage giants ordered to exempt first-time homebuyers from increases which could boost private lending Getty Images.

Fannie and Freddie are currently owned by the United States government and regulated by the Federal Housing Finance Agency. While GSEs are publicly traded companies they all serve a very public mission of supporting the nations financial system. Mortgages Perfected Over 30 Years.

There are several other GSEs like the Farm Credit System. Its purpose was to provide lenders with funding to make home loans by buying the lenders mortgages. Fannie Mae was privatized in 1968 and Freddie.

4 2008 the last thing then-President George W. Fannie and Freddie are private corporations that were chartered by Congressthe formal term for this kind of company is a Government Sponsored Enterprise. November 29 2021.

What are Fannie Mae and Freddie Mac. Retrieved September 7 2008. Governmentsponsored enterprises Fannie Mae and Freddie Mac took a major step forward in their efforts to close the homeownership gap between white and minority.

When you hear or read about conforming or conventional mortgages know the reference is to Fannie and Freddie mortgages. Shares of Fannie Mae and Freddie Mac dove to their lowest levels in more than 18 years on mounting fears of a government bailout that would wipe out shareholders of the two US. Statement of FHFA Director James B.

Fannie Freddie regulator wants to help more low. Federal Housing Finance Agency. Median Loan Size and Number of Units for Multifamily Loans Financed by the Enterprises Life Insurance.

Fannie Wants Desktop Appraisals With Floor Plans Appraisal Today

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

Enterprise Architecture Architecture Senior Director Hybrid Remote Fannie Mae Ladders

Calculated Risk February 2018

2

Freddie Mac Short Sale Process Flow Chart Not Sure If You Have A Fannie Mae Freddie Mac Or Non Gse Loan You Can Process Flow Chart Flow Chart Process Flow

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

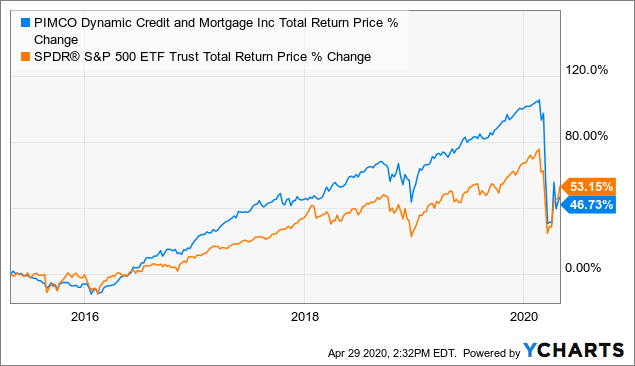

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha

2

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Mortgage Dreams Florida Home Facebook

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

What Are Pass Through Bedrooms For Appraisals Appraisal Today

Mis 3090 It For Financial Services Real Estate And It August 27 Ppt Download

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha

Desktop Appraisals Lots Of Info Available Appraisal Today